tax avoidance vs tax evasion examples

This is generally accomplished by claiming the. The first one is the evasion of assessment which includes not informing tax authorities of your exact income.

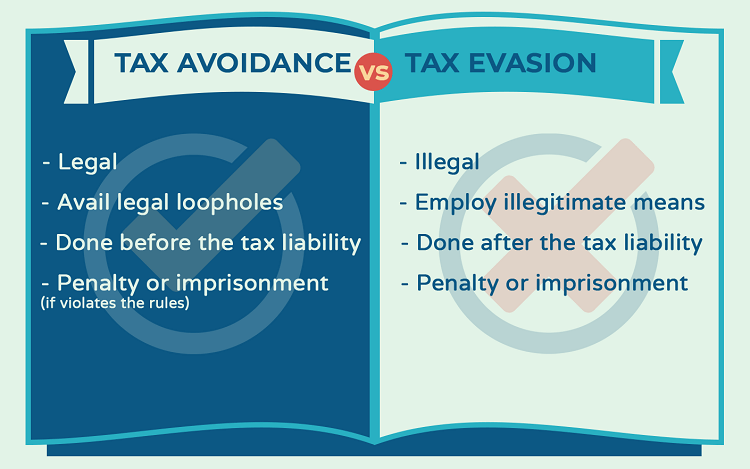

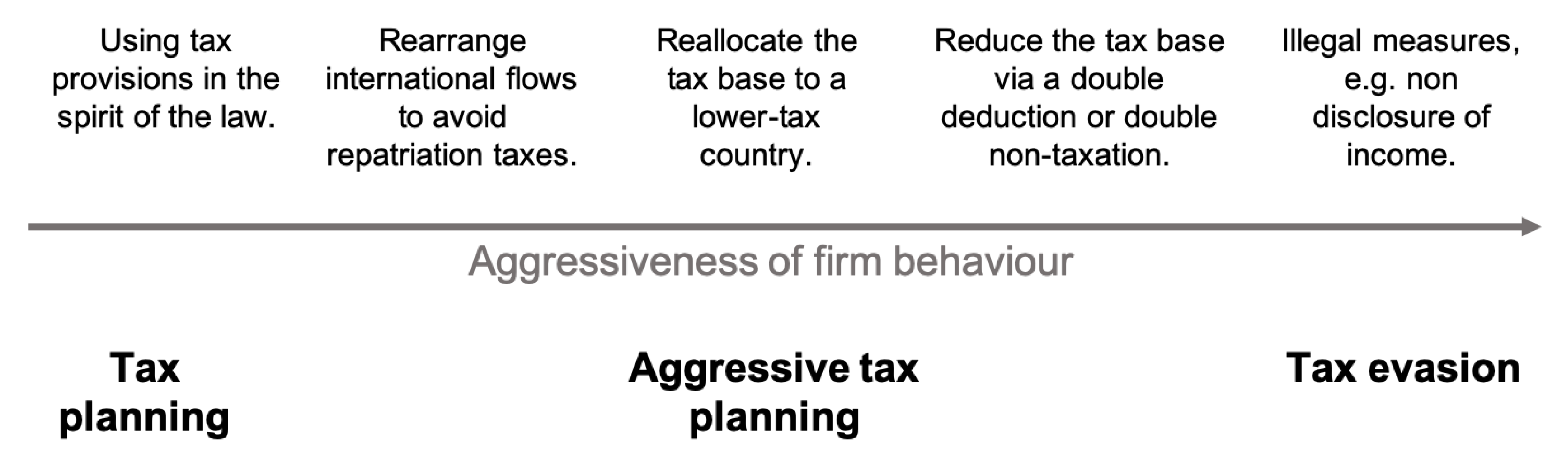

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Putting money in a 401 k or deducting a charitable donation are perfectly legal methods of lowering a tax bill tax avoidance as long as you follow the rules.

. Tax evasion is totally different from tax avoidance. ï Failing to declare assessable income ï Claiming deductions for expenses that were not incurred or are not legally deductible ï Claiming input credits for. If income is not reported by.

This often affects people with rental properties overseas. 4 rows Falsifying accounts manipulating accounts overstating expenses understating income and. Tax avoidance is different from tax evasion.

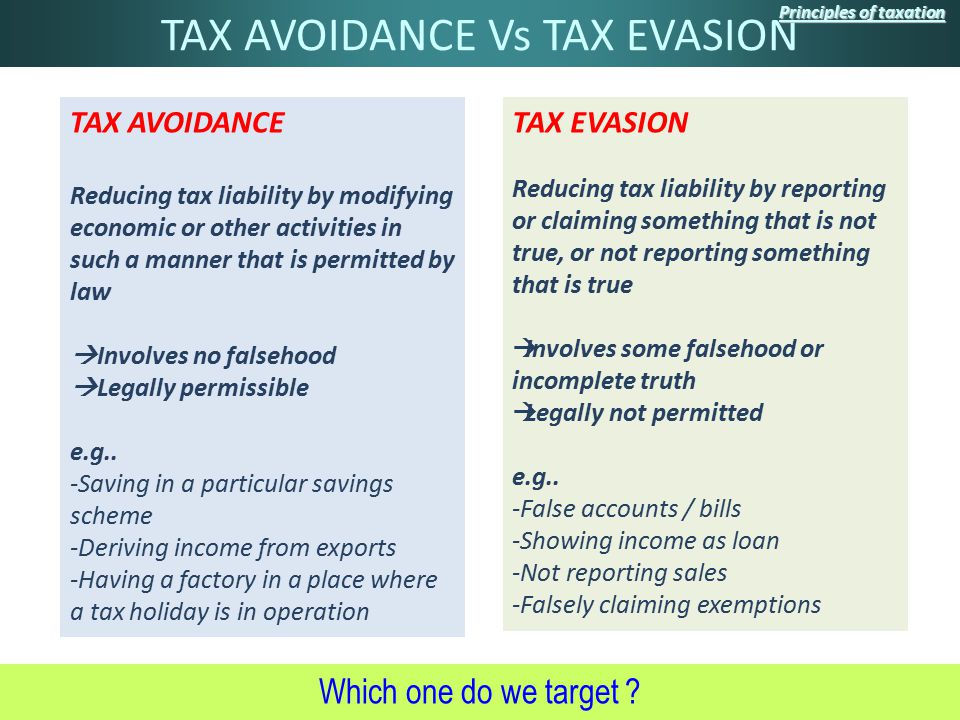

Some examples of legitimate tax avoidance include putting your money into an Individual Savings Account ISA to avoid paying income tax on the interest earned by your cash. Tax avoidance is different from tax evasion which involves illegal ways of getting rid of the tax responsibilities or conducting tax frauds. Tax evasion is illegal and can potentially get you criminally charged and sentenced to prison fined or both.

Tax evasion on the other hand. Though it is completely ethical to keep the taxes as. Tax avoidance is the legitimate minimizing of taxes and maximize after-tax income using methods included in the tax code.

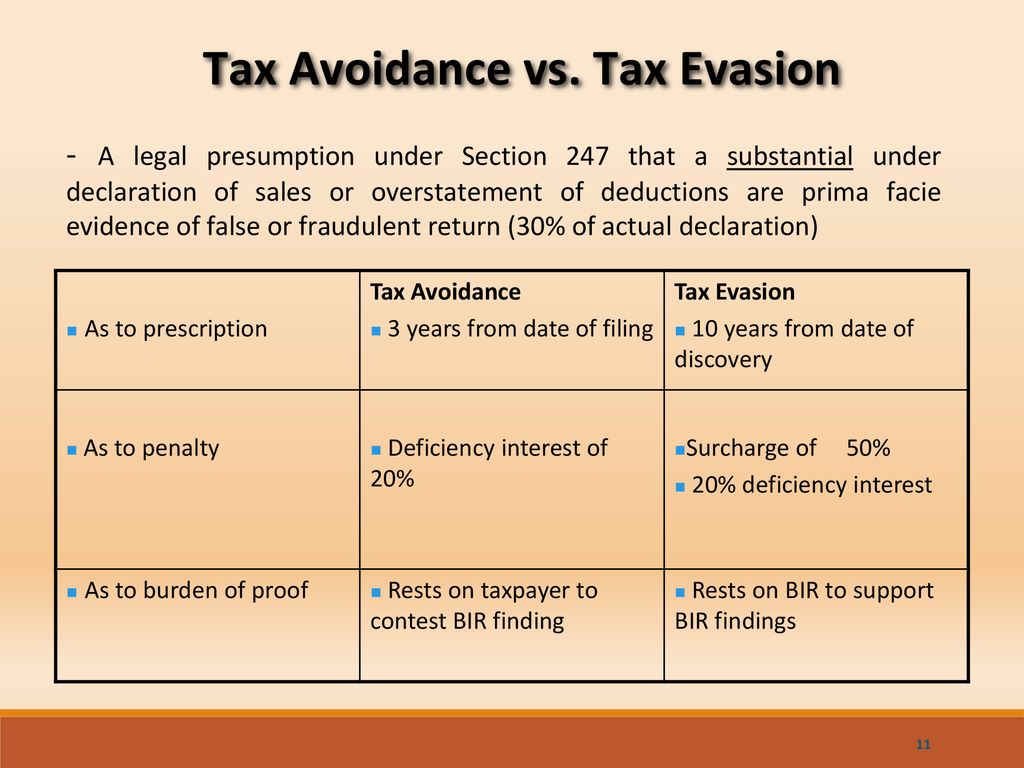

There are mainly two types of tax evasion. If caught the person may have to face an enormous penalty. The result of tax avoidance is the postponement of the tax whereas the consequence of tax evasion if the assessee is found guilty of doing so is either imprisonment or penalty or.

Canada Revenue Agency states that while tax avoidance is technically within the letter of the law the actions often contravene the object. Businesses avoid taxes by taking all legitimate. Tax avoidance is the use of tax-saving devices within the means sanctioned by law and where the taxpayer acts in good faith and at arms length.

Tax Evasion is basically non-payment of taxes by means of not reporting all taxable income or by taking not allowed. What Is Tax Evasion. Tax avoidance is the use of legal methods to modify an individuals financial situation to lower the amount of income tax owed.

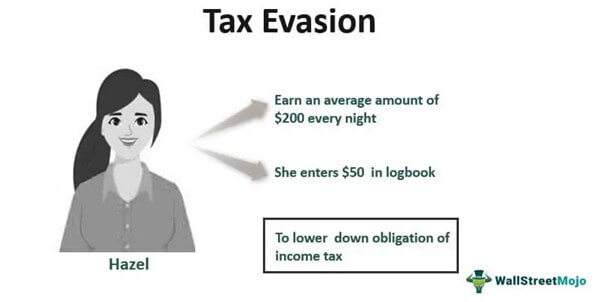

Here are some examples of tax evasion. Tax evasion occurs when the taxpayer either evades assessment or evades payment. Tax avoidanceAn action taken to lessen tax liability and maximize after-tax income.

Examples of tax evasion are. This method is certainly illegal in all the countries. Tax evasionThe failure to pay or a deliberate underpayment of taxes.

Tax evasion is the use of illegal means to avoid paying your taxes. 1 Ignoring overseas income. While tax evasion and tax avoidance sound similar theyre far from interchangeable.

Tax evasion is often confused with tax avoidance. Here are some examples of tax avoidance strategies. Examples of tax evasion.

If income is not reported by.

Tax Avoidance Definition Business Examples Tax Saving Loopholes

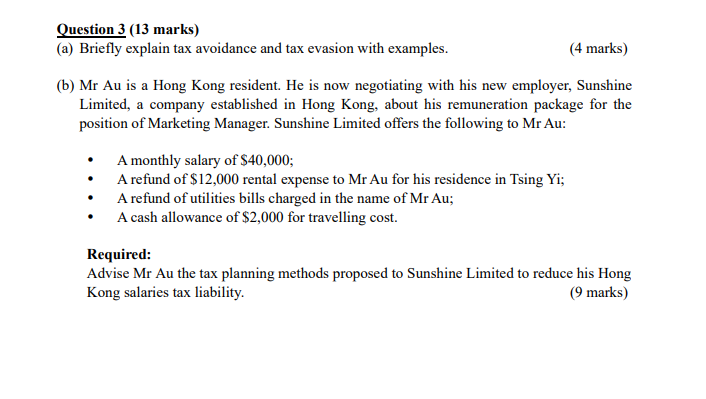

Solved Question 3 13 Marks A Briefly Explain Tax Chegg Com

Which Countries Are Worst Affected By Tax Avoidance World Economic Forum

Difference Between Tax Avoidance And Tax Evasion With Comparison Chart Key Differences

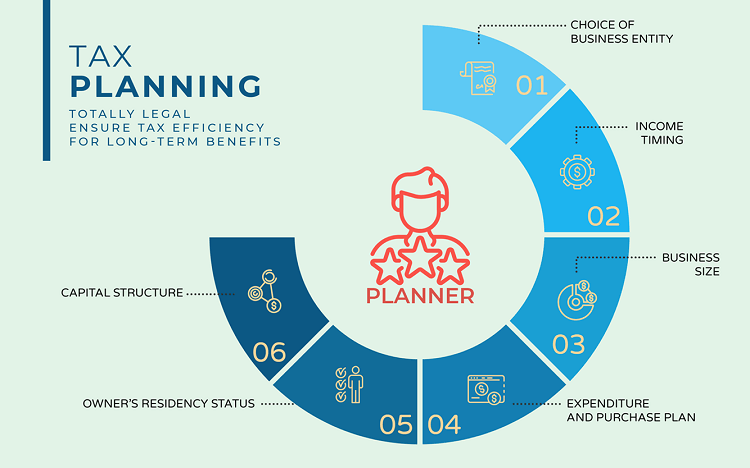

Differences Between Tax Evasion Tax Avoidance And Tax Planning

Top 14 Tax Evasion Quotes A Z Quotes

Games Free Full Text Gaming The System An Investigation Of Small Business Owners Attitudes To Tax Avoidance Tax Planning And Tax Evasion Html

Principles Of Taxation Ppt Download

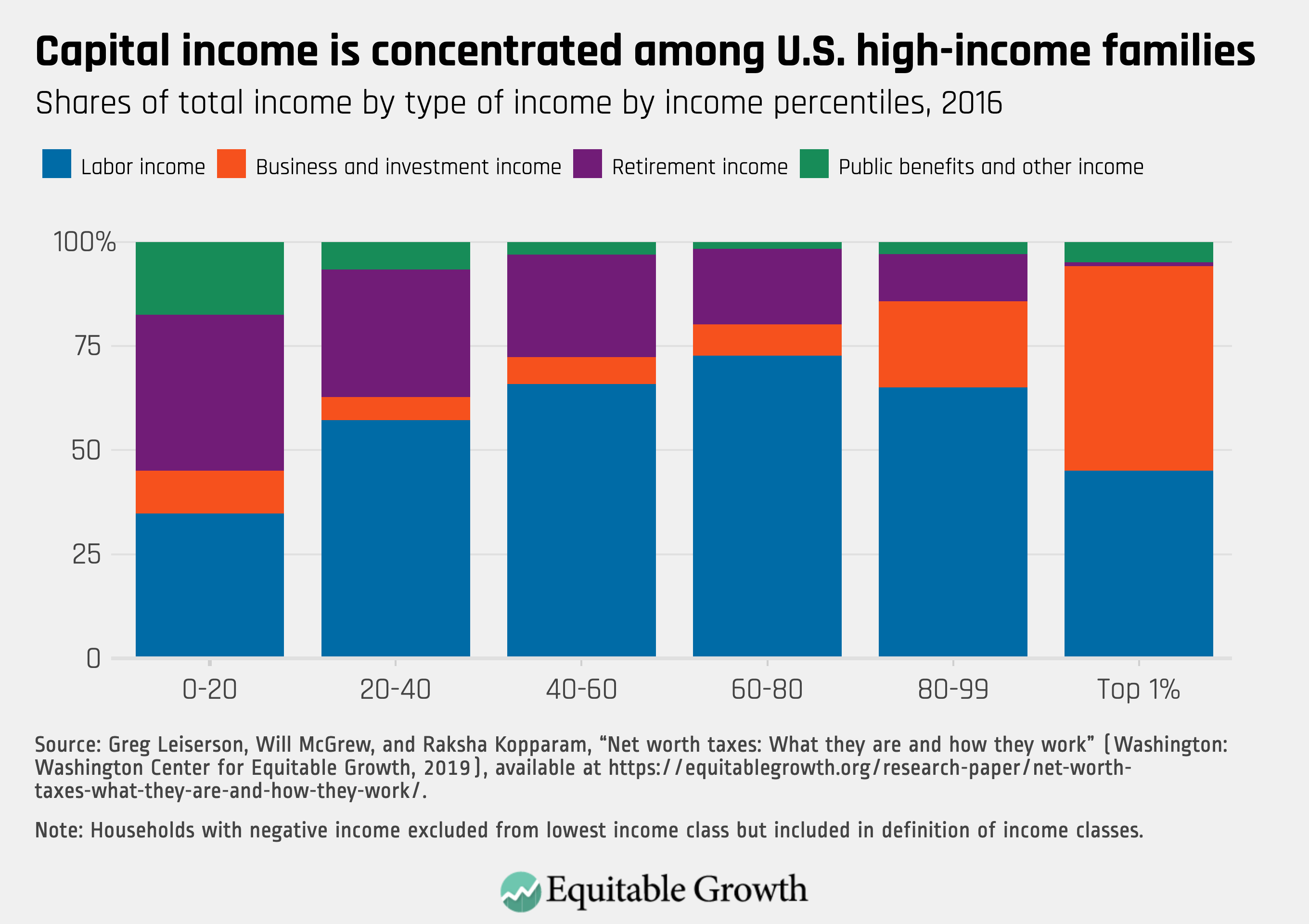

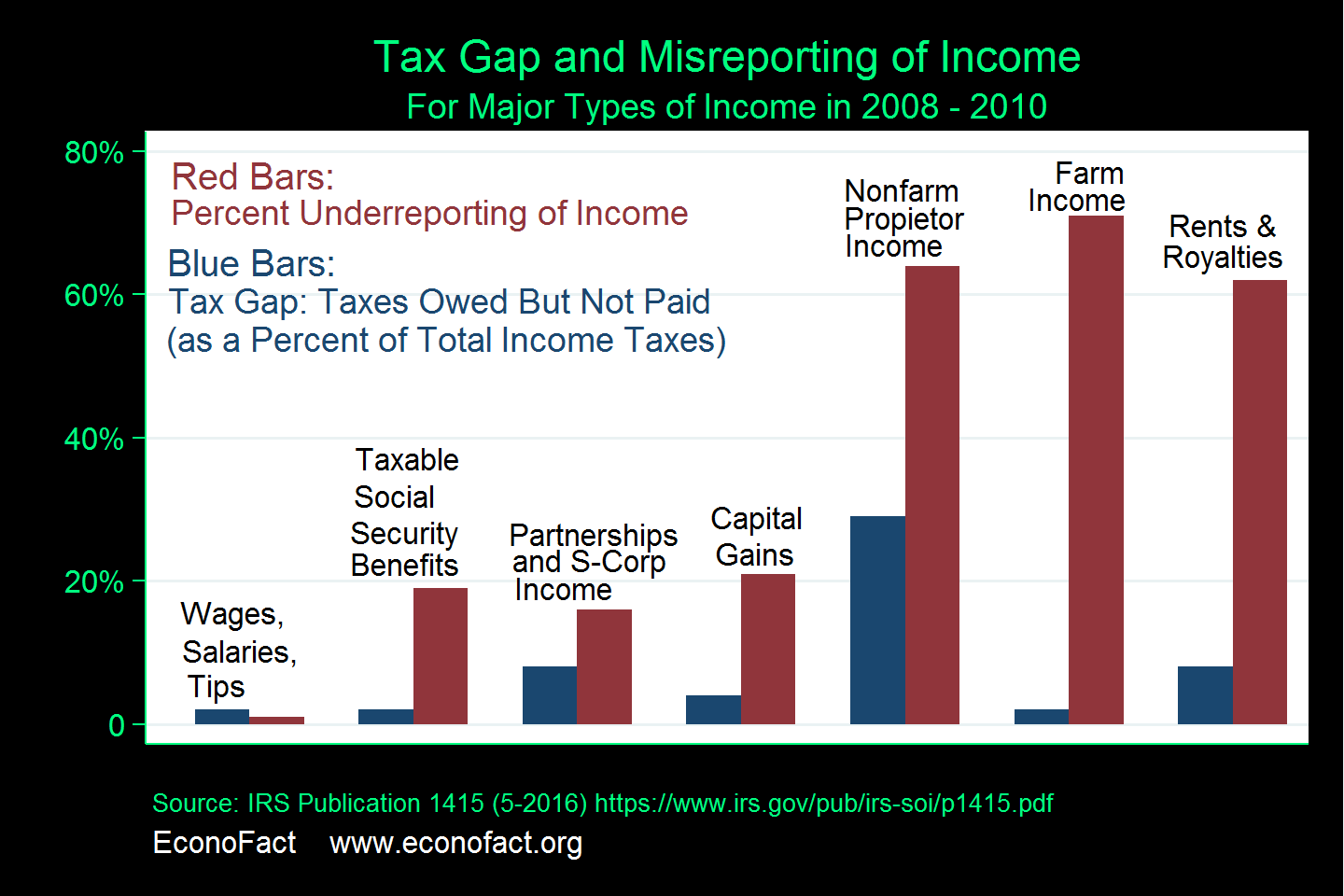

The Sources And Size Of Tax Evasion In The United States Equitable Growth

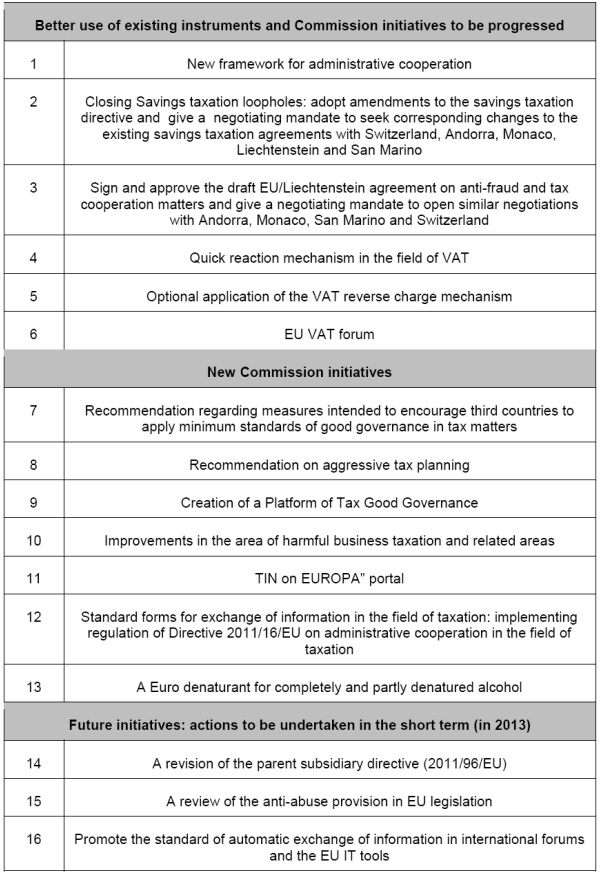

Tax Evasion And Avoidance Questions And Answers Europawire Eu The European Union S Press Release Distribution Newswire Service

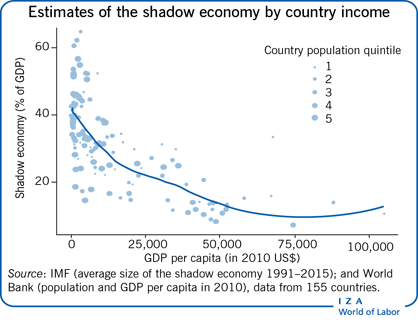

Iza World Of Labor Tax Evasion Market Adjustments And Income Distribution

How Big Is The Problem Of Tax Evasion Econofact

Is Tax Evasion A Federal Crime Premier Criminal Defense

Tax Evasion Meaning Types Examples Penalties

How To Reduce Your Tax Legally And Ethically Ppt Download

Tax Evasion Vs Tax Avoidance Difference Examples Supermoney

Tax Evasion And Tax Avoidance Definitions Differences Nerdwallet